- Duration: 20 hours

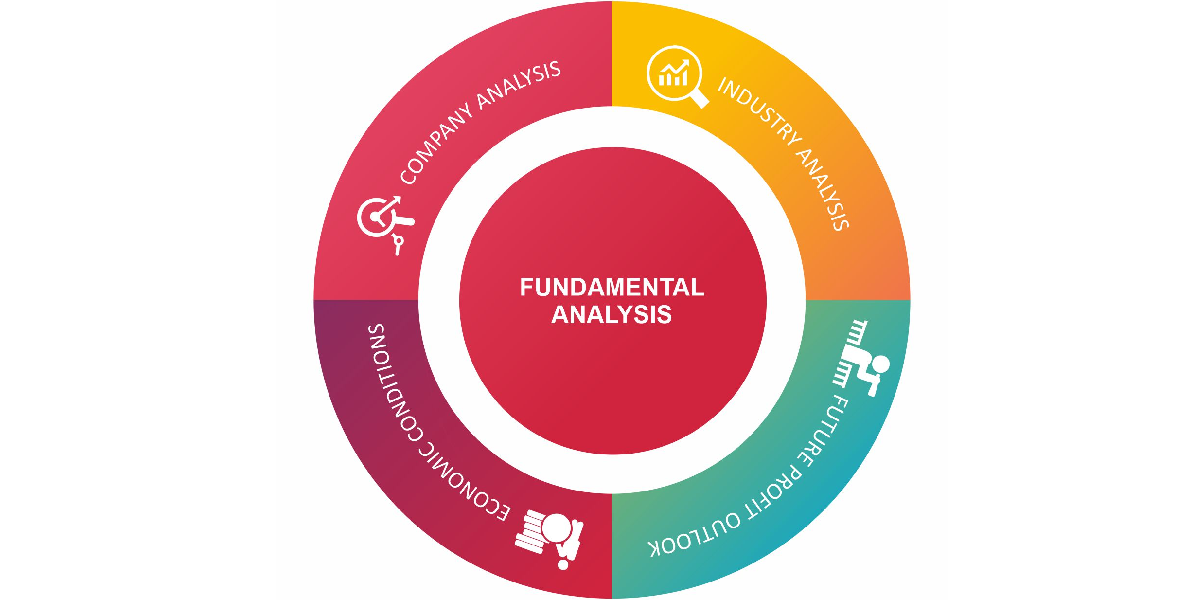

This course will give you the necessary knowledge to conduct a fundamental analysis in the stock market. The course includes some practical analysis that will familiarize you with the analyzing process. Realizing a fundamental analysis will help you identify the “WHAT” for selecting the stocks you will invest in. It includes analyzing the company’s financial statements to compare them with the industry average and determine if the stock has enough value before considering it as an investment. To succeed with individual stock picking, it is essential to do the homework before selecting the right companies.

Topics covered

1. What is Fundamental Analysis?

2. What is a Business Model?

3. Standalone & Consolidated Financial Statement

4. SWOT analysis

5. Quantitative Analysis

· Financial statements analysis (Balance sheet, p &1, Cash flow)

· Financial Ratios Analysis (Debt- Equity, Current, P/E ratio, P/B ratio, ROCE, ROE, Inventory Turnover, EV/EBITDA)

6. Qualitative Analysis

Curriculum

- 1 Section

- 14 Lessons

- 20 Hours

- OverviewIn this section we'll show you how this course has been structured and how to get the most out of it. We'll also show you how to solve the exercises and submit quizzes.14

- 1.1Fundamental Analysis V118 Minutes

- 1.2Fundamental Analysis V2

- 1.3Fundamental Analysis V3

- 1.4Fundamental Analysis V4

- 1.5Fundamental Analysis V5

- 1.6Fundamental Analysis V6

- 1.7Fundamental Analysis V7

- 1.8Fundamental Analysis V8

- 1.9Fundamental Analysis V9

- 1.10Fundamental Analysis V10

- 1.11Fundamental Analysis V11

- 1.12Fundamental Analysis V12

- 1.13Fundamental Analysis V13

- 1.14Fundamental Analysis V14